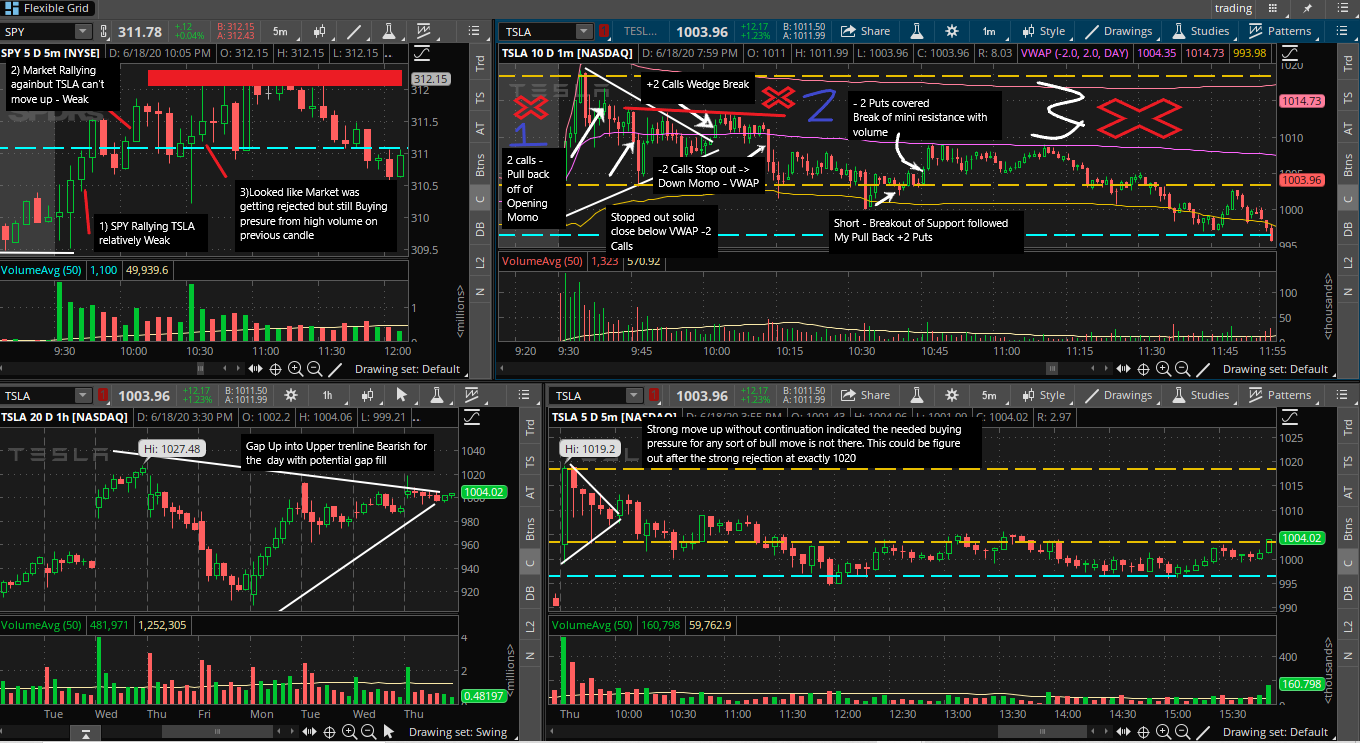

TSLA

TSLA:

General Info: On the catalyst side the stock had an upgrade to a target of 1200 that morning making it likely to be bullish. This also meant the stock was a stock in play.

Trade 1: The mistake here was first not paying attention to the huge rejection volume at the key level indicating the move was likely over. The mistake also related to the fundamental idea of a pullback being a rest for a stock not a rejection. The fundamental mistake here was trying a pull back trade on a stock at major resistance and already extended .

Trade 2: The trade over all was not bad however the massive volume at the pivot point prior in the formation of the wedge indicated huge sellers sitting right above the breakout point of the wedge. To avoid getting stuck in a loser like this on triangle and wedge plays it is often best to wait till the nearest minor pivot breaks with volume or a major volume spike comes in indicating strong sentiment in the direction of the trade.

Trade 3: Here the warning lay in the volume. The stock originally broke out on a market spike down seen by watching SPY. Chasing market spikes is dangerous so waiting for a pull back is the best option. This is the plan used in this trade however, here the strong volume on the two bars indicated strong buyers below meaning it is best to avoid the trade or wait for a break and close below that new low.

Overall today TSLA was hard to trade and chasing was my biggest problem.

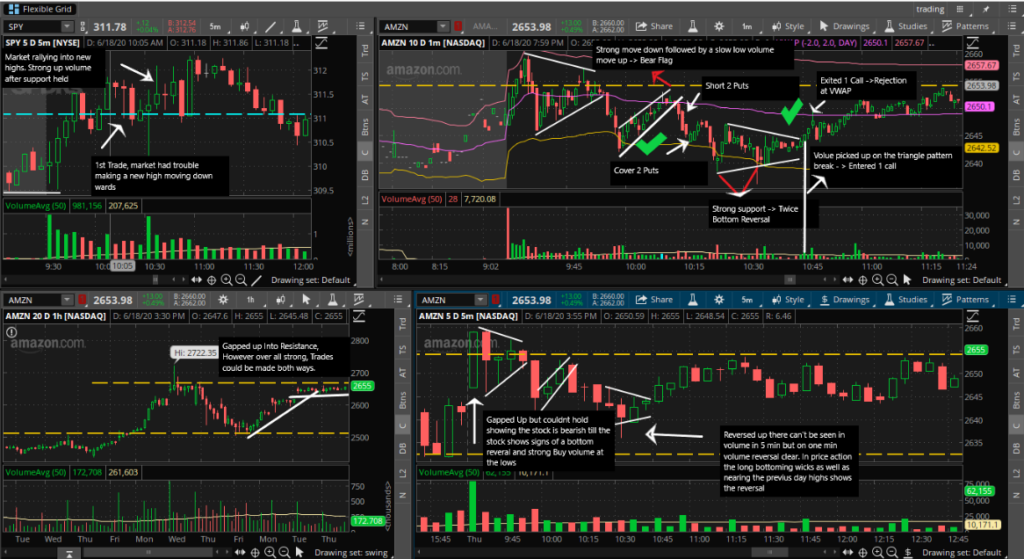

AMZN

AMZN:

Trade 1: Good trade once the momentum showed it was too the downside. The trade provided good risk to reward and was in the direction of the overall trend of the stock.

Trade 2: This trade was a very good reversal trade because of how volume indicated strong support shown in the picture. After this, it was a classic triangle breakout followed by pull back continuation

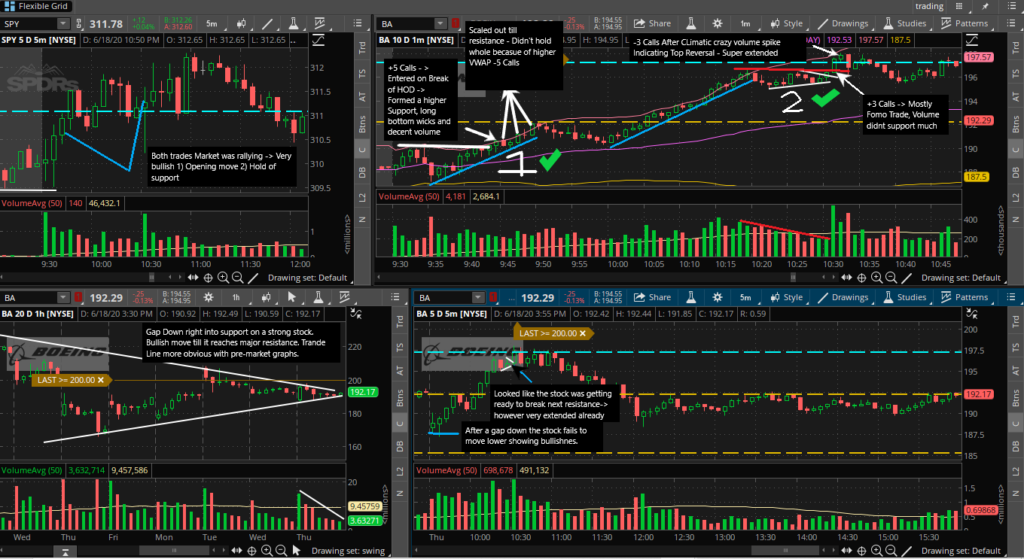

BA

BA:

Trade 1: Clean HOD break on a stock holding support on a larger time frame very clearly. Volume overall showed strong buyers on the open. Classic HOD play.

Trade 2: Not such a good trade because the stock is already very very extended and is at major resistance. I chased a quick scalp which worked out but as can be seen the stock quickly reversed.

BA was a crazy runner today. Should have held some in general.

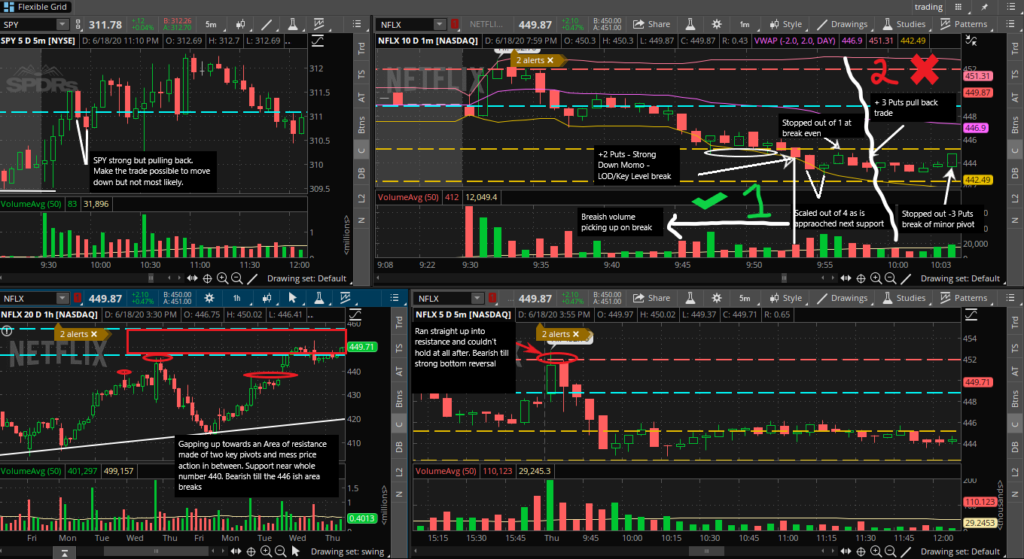

NFLX:

NFLX:

Trade 1: Good LOD/ Key level break. This biggest problem here was the bad risk to reward offered because of how close the next major pivot area was. I scaled out of most knowing support was near but still got stopped out of some at break even.

Trade 2: Bad trade over all . Tried playing a pull back after the stock showed major support in the buying volume after the first pivot. Also did not wait for the candle to form and chased.

NFLX is a corona virus stock and moves opposite the market often. This factors into how the market is used and the overall trend of the stock.