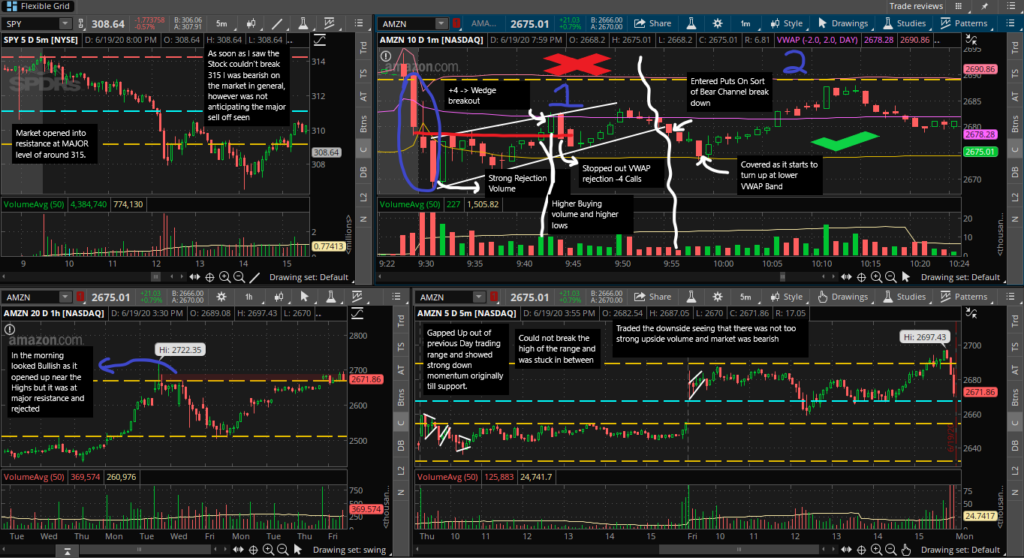

AMZN:

- The problem with this was that I let my bias block out what the chart was showing me. After seeing the market push up and look bullish pre-market expecting a breakout or continuation to the upside so I chased the stock up on a wedge pattern breakout. The larger problem here is that I bought AMZN right into the VWAP without waiting to see a clear candle close above the VWAP. On top of this it was already up a few candles and had already bounced and needed to rest. Therefore when this trade didn’t workout it was clear in hindsight why.

- This was a play of the continuation to the downside seeing the strong sell momentum however the consolidation in the form of a bear flag had been forming too long to expect an especially strong continuation too the downside.

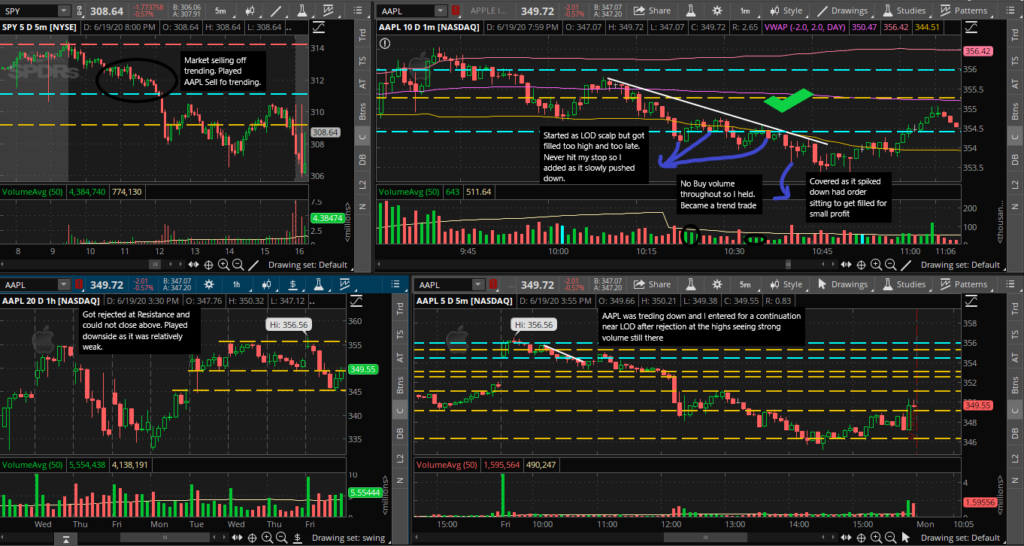

AAPL:

- The first problem with this trade is I tried to play a LOD break on a trending stock. When a stock is trending it normally will move one or two bars past the previous pivot before pulling back. I had to add and average down at pivots to work against time decay and close the trade out in profit. This became a trend trade.

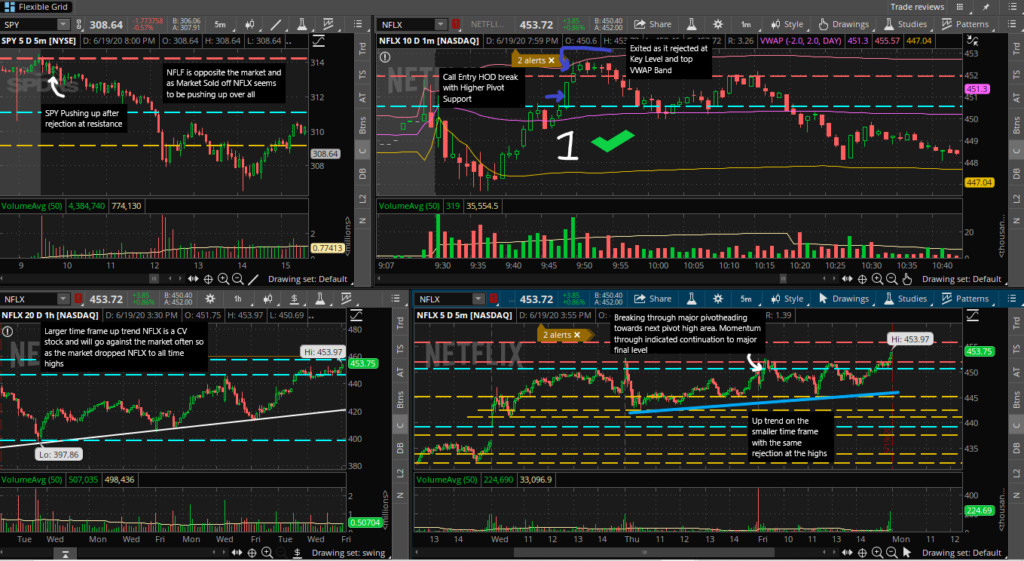

NFLX:

- I entered here on HOD break which was also a first pull back in an uptrend. I got out near my next key level. This was an easy trade because the stock was not extended and was a clean trade with volume.

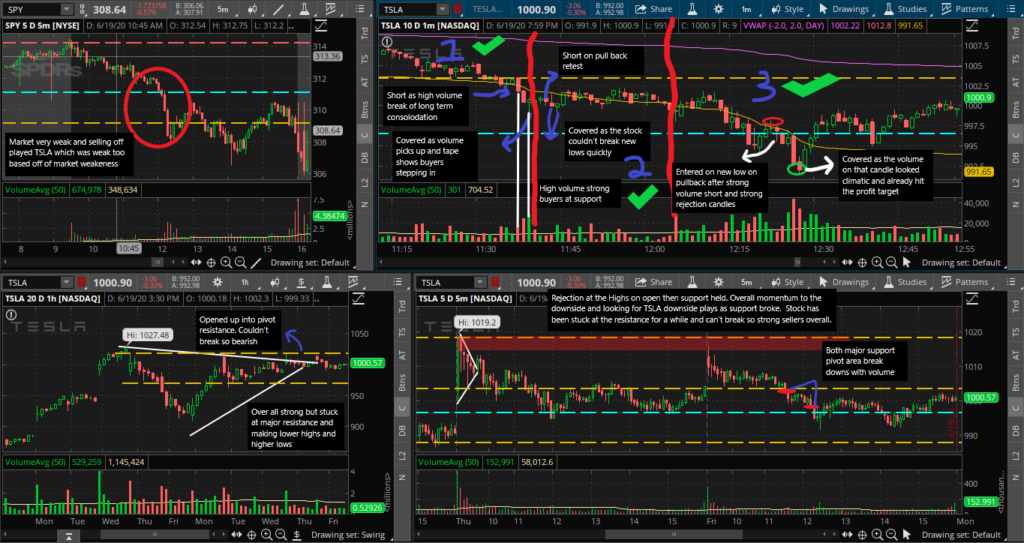

TSLA:

- First trade long held consolidation near the lows and then a breakdown with strong sell volume. The exit at the first sign of buyers stepping in. Break of a key level of support as well.

- The pull back of the first trade however the mistake here was that the previous exit showed strong buyer which means a pullback is not a valid trade.

- Shorted a pull back using strong volume rejection candle after strong move down and a heavy sell off. Perfect volume fade on the buy side showing no buyers.

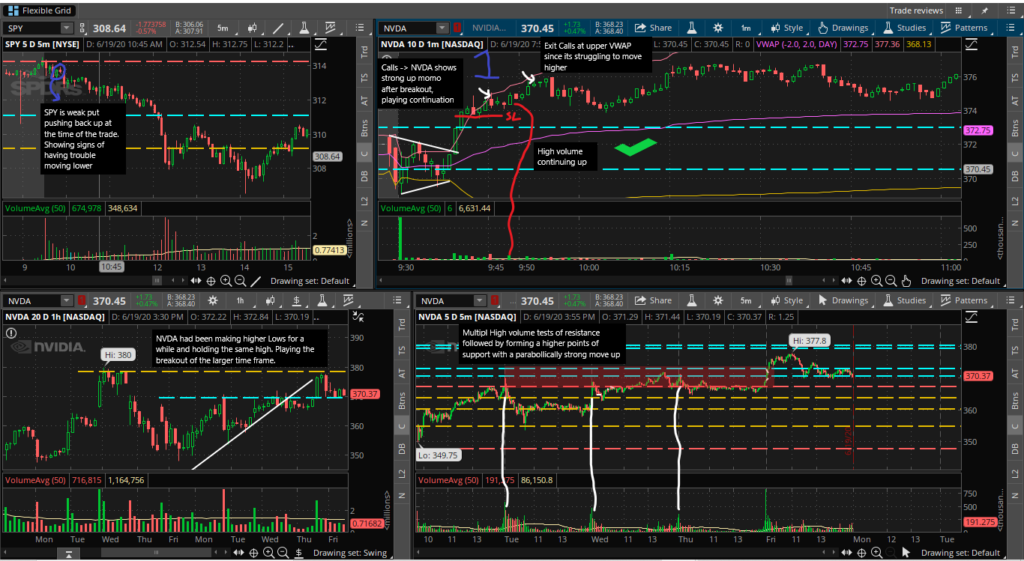

NVDA:

- This was a continuation off an initially strong triangle break out. The stock consolidated then ran to a new high. I entered at the top with a stop at the bottom of the range since it was near by. Trade was slow moving but worked.