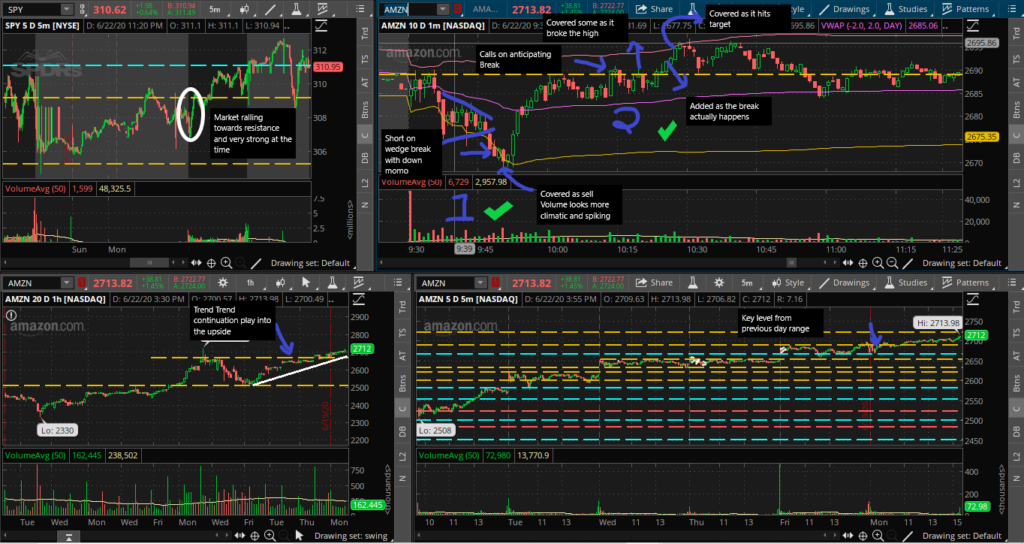

AMZN:

- Stock rejected at a key level then consolidated showing overall downward momentum. Entered as a triangle consolidation broke to the downside and scalped a little bit.

- The problem here was a entered without seeing an actual HOD break and anticipated it but the stock pulled back. Added when the actual break happened an scalped it higher.

ROKU:

- Tried to play the HOD break but the warning here lay in the fact that the stock already failed to make significant new highs on the last attempt showing increasing selling pressure and decreasing buying pressure.

- This was a play following a top reversal attempting to follow momentum to the downside. The problem here was it was more of trending down and wasn’t right to play a downside break because the sell pressure wasn’t too strong and there wasn’t major support.

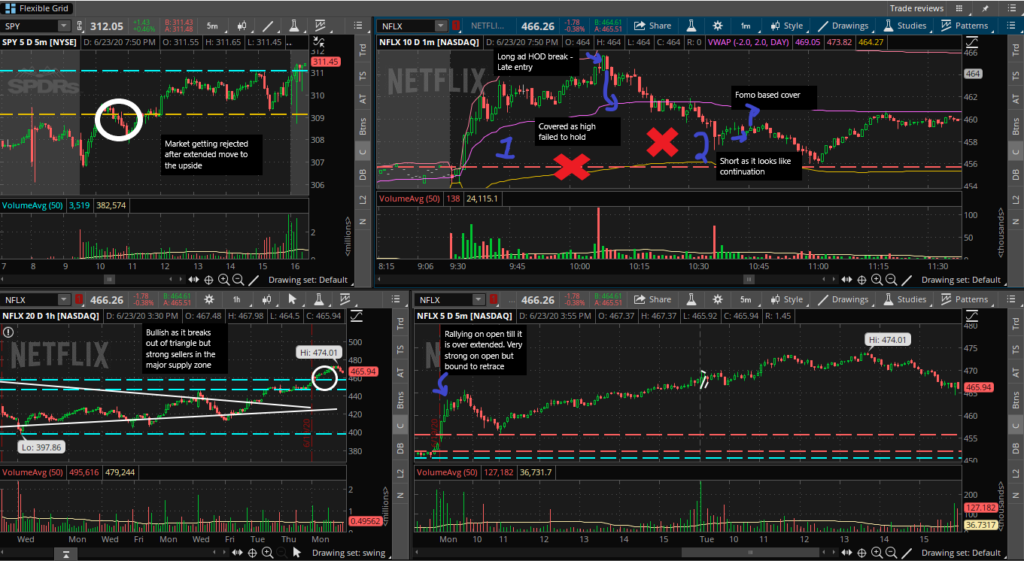

NFLX:

- This was an attempt to play the HOD of break. The problem was that the entry was very late and the stock was already extended up and second that the stock was already struggling to make new highs so a HOD break wasn’t the best play to make.

- The key problem here was a way too early exit. This was a pull back play after a strong move down looking for continuation. The only problem here was not holding and exiting without waiting for the candle close.

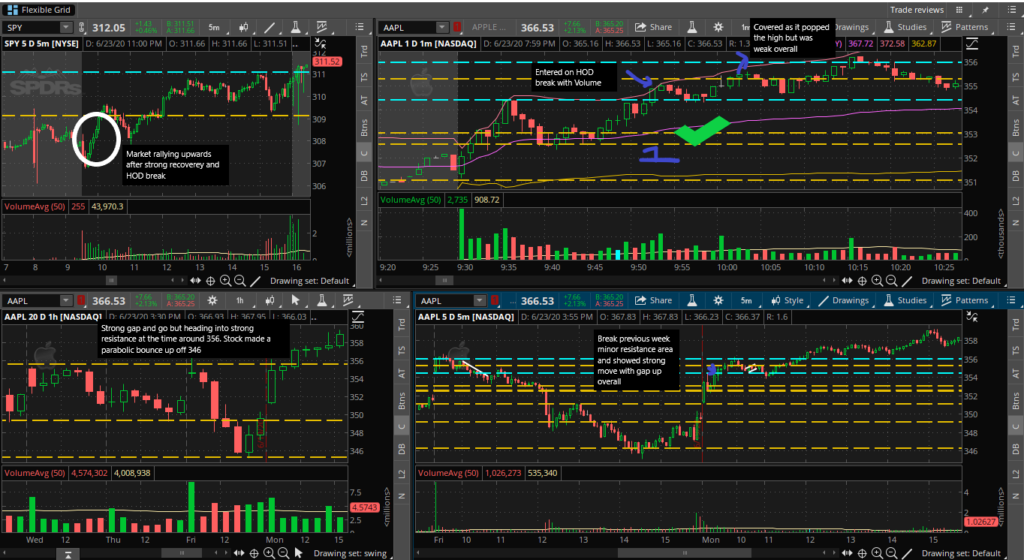

AAPL:

- This was a HOD break play. The stock showed strength through how it held during the pull back then made a strong move back towards the highs. The entry was at the HOD break and was held through a pull back since the stock was trending into new highs.

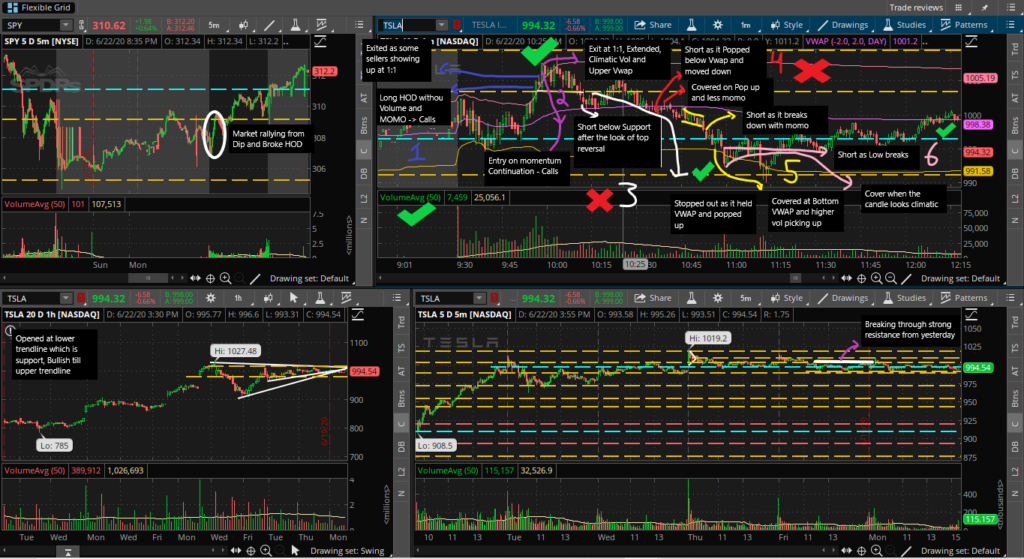

TSLA:

- This was a classic HOD break as the stock showed a lot of up momentum and only had a small pullback. Volume supported it.

- This was a continuation and was a chase off the early exit from the last play, however it worked out well.

- Tried shorting after seeing it top reverse. The problem here was first that it had already made a strong move down and second that the VWAP was right there and can act as a strong support level.

- This was a good short play however it stopped out too early on a quick pop back above the VWAP. If held, this was a major win.

- Continuation on momentum to the downside as the stock kept pushing lower. This trade was mostly generate by FOMO.

- Another FOMO play holding for a quick dump seeing the strong volume and momentum to the downside.