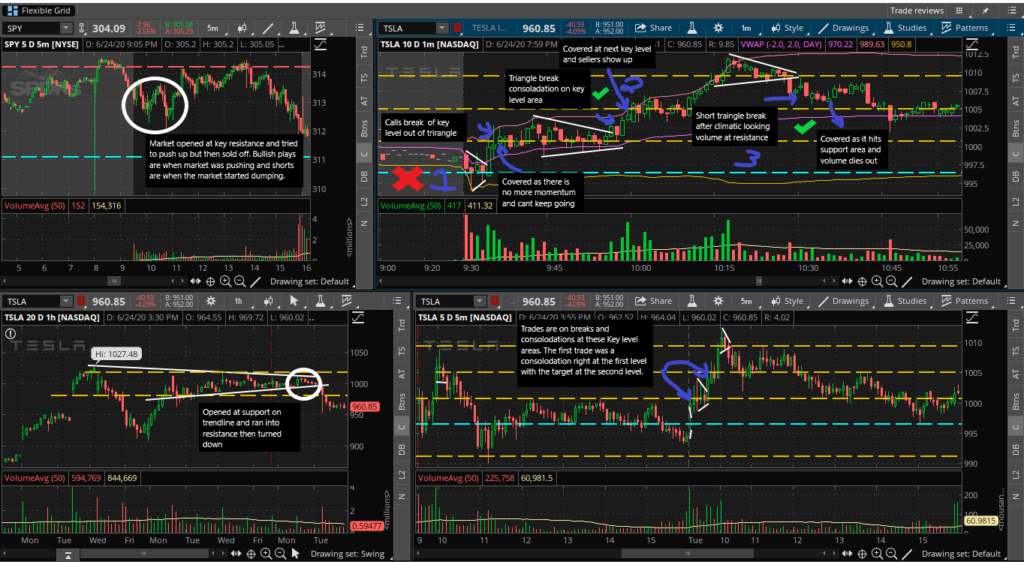

TSLA:

- Here the mistake was chasing it after it was already up like that especially during the first few minutes which is way more volatile. The trade was find in the fact that it was a key level break preceded by a pattern. This trade overall was not bad. Just should have got in early and scaled out quicker.

- This was a good trade and good exit but could’ve held a little longer to see if the next candle would push into the candle again which is common for TSLA.

- This was a good top reversal short with a good exit, however should have added on the pull back once the rejection candle formed perfectly. This was a risky trade though since I chased down.

AMZN:

- This was a very bad trade in that the pure basis of is was anticipation of a breakout and was biased. Better plan is to wait for the breakout.

- This was a good triangle breakout trade which rewarded holding through a small pull back which I should have added size too. The volume was nice and the volume showed a perfect squeeze to breakout.

- This was a good trend continuation triangle setup which allowed a play for the break of HOD while avoiding chasing as the break happens which should not be done on trending stocks.

- This again was full anticipation and chasing HOD on a trending stock instead of waiting for a pull back or even trading the actual HOD break and close.

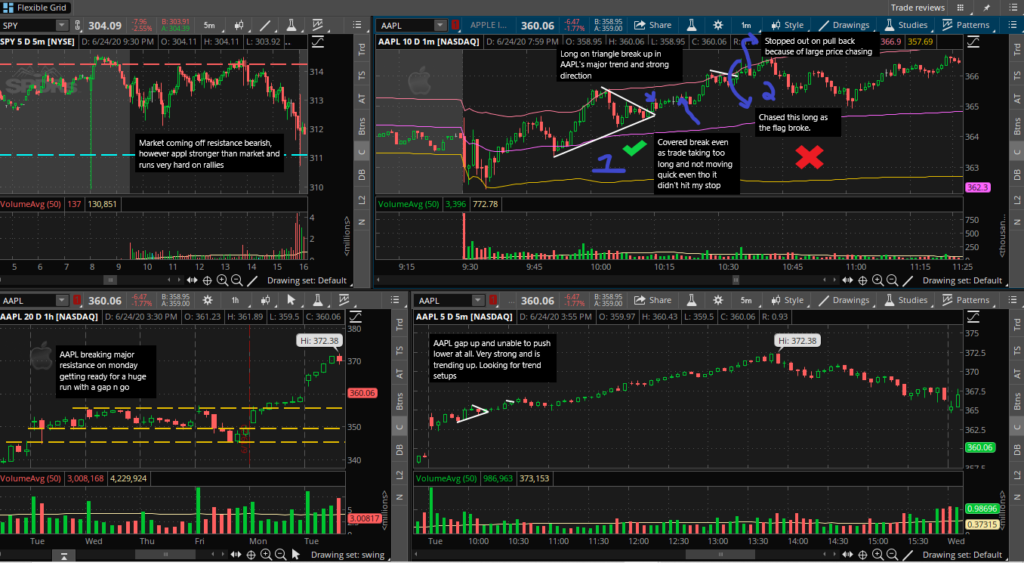

AAPL:

- This was a strong triangle patter in a stock that was obviously bullish on the intermediate time frame. This was a good play supported by the volume shown earlier on the rally and the increase in volume near the apex.

- The mistake here was chasing into the HOD. As a stock runs longer the trend is more likely to end and any entry has to be early on. Instead this play was a chase as it popped up which is where the exit for this trade should have been. The stop out should have been immediately after seeing the rejection candle form.

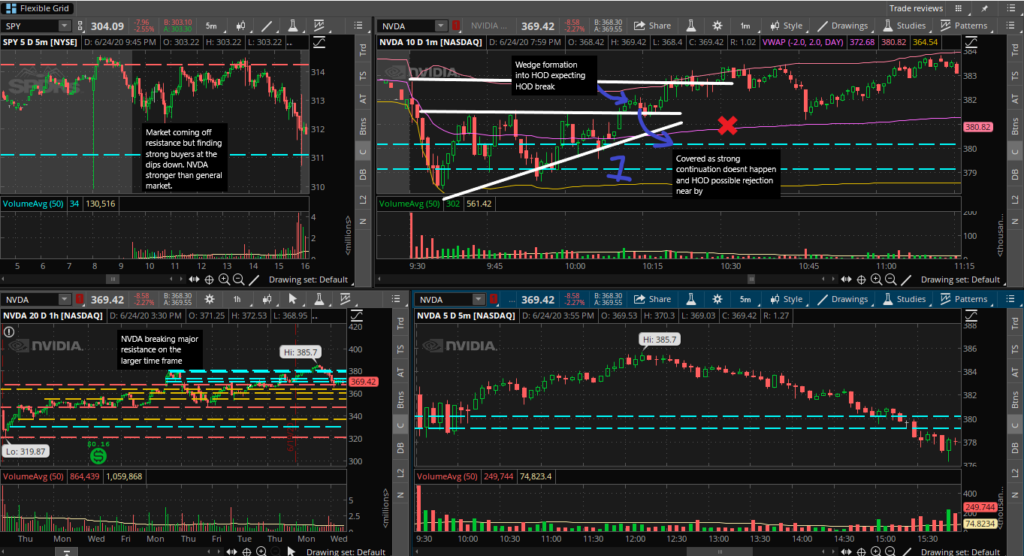

NVDA:

- This first place was a entry over all and just pulled back and seemed bearish giving me a reason to exit. Eventually this worked and ran into HOD but the pull back and rejection candle gave me reason to preemptively exit taking a small loss.

ZM:

- This was by far the worst play. The previous day LOD which can act as pivot support was right at my entry causing an immediate bounce. Instead of looking for why this good setup failed, averaging down became the new plan leading to a huge loss.