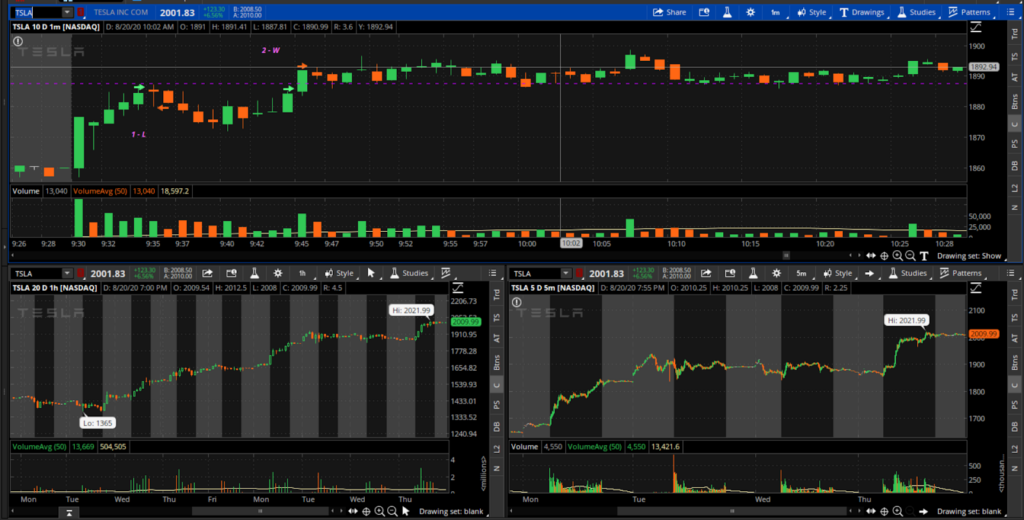

Ticker: TSLA

Trades: 1/2

Daily Catalyst (Fundamental or Technical): Momentum Continuation or Anticipation of new highs

Longer Term Catalyst: Battery day, Anticipation of S and P 500 Addition, 5 to 1 Split, Being TSLA

Bias: Preferable Long, Short also okay

Play Type: Momentum HOD anticipation on support bounce

Chart:

Bigger Time frame reasoning: TSLA was bouncing up off support after a weak AH and PM.

Reason for entry: Strong opening pushing up against pre market resistance. A lot of buying tails.

Reason for exit: Stopped out as I recognized it was rejecting the level and failed to close above the level.

Review: Bad bad play. Same as yesterday’s chase on the open. The mistake was it was up 5 candles already and was not holding. Should not have entered this without a rejection and a pullback or a close and break above the high of premarket.

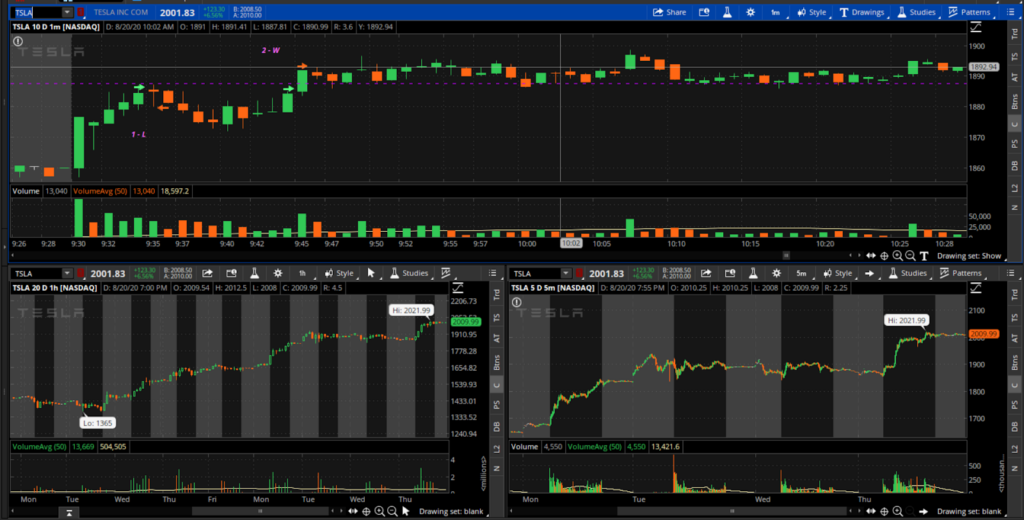

Ticker: TSLA

Trades: 2/2

Daily Catalyst (Fundamental or Technical): Momentum Continuation or Anticipation of new highs

Longer Term Catalyst: Battery day, Anticipation of S and P 500 Addition, 5 to 1 Split, Being TSLA

Bias: Preferable Long, Short also okay

Play Type: Momentum HOD anticipation on support bounce

Chart:

Bigger Time frame reasoning: TSLA was bouncing up off support after a weak AH and PM.

Reason for entry: Volume and momentum were picking up as they pushed HOD.

Reason for exit: Extended two bars up and had no need to hold through pullback. Hit about 8% already on the scalp.

Review:

Clean Play as it was pushing. Very good execution as I entered before the break instead of after when I had the chance to make the trade. Could’ve entered on the previous candle instead of this one. That would have made this trade a little better.

Ticker: BABA

Trades: 1/1

Daily Catalyst (Fundamental or Technical): Had earnings, Pushing down premarket

Longer Term Catalyst: China America Trade deal news, JD running

Bias: Short due to premarket weakness

Play Type: Opening range Short breakout on post Earnings weakness

Trade type: Scalp

Chart:

Bigger Time frame reasoning: Pushing down big time breaking long term uptrend line.

Reason for entry: Pushed the premarket lows then failed to move higher. Entered short is it approached LOD with momentum volume and SPY pushing down.

Reason for exit:

Scaled out of 5 contracts as it pushed down into the weakness. Popped up quick and stopped out of the rest at breakeven. Didn’t like the choppiness in the morning plus the premarket not having to clear a low.

Review:

Okay trade that had very good execution and exit as it popped back up. I remembered my rule that in the first 5 to 10 minutes you have to be aggressive on entries and exits.

Ticker: NVDA

Trades: 1/2

Daily Catalyst (Fundamental or Technical): Beat Earnings yet pushed down, Recovery, Upgrades and maintains on PT

Longer Term Catalyst: In a run up pre earnings

Bias: Long due to gap and earnings

Play Type: PM High/ HOD break on earnings Recovery

Trade type: Scalp

Chart:

Bigger Time frame reasoning: PM pushed down and held support failing to move lower.

Reason for entry: Breaking PM high and HOD with volume and clean up trend. Second leg up.

Reason for exit:

Rallied nicely and got ten percent off the contract. Seemed extended.

Review:

Good execution and good entry. Very bad job not holding. When there is a retest it is much more important to hold for a longer and expect a bigger move.

Ticker: NVDA

Trades: 2/2

Daily Catalyst (Fundamental or Technical): Beat Earnings yet pushed down, Recovery, Upgrades and maintains on PT

Longer Term Catalyst: In a run up pre earnings

Bias: Long due to gap and earnings

Play Type: HOD break on earnings Recovery

Trade type: Scalp

Chart:

Bigger Time frame reasoning: PM pushed down and held support failing to move lower.

Reason for entry: Breaking HOD after length consolidation. Had been pushing higher within the range and holding the highs better.

Reason for exit:

Tape rejected massively in 495. The profit takers and sellers were sitting there. The second I saw the clean rejection I confirmed I got out for a small loss.

Review:

Decent execution and trade. Should have waited to see momentum pick up towards 495 or the confirmed break and hold. Mistake here was getting in without taking into consideration the 495 break.

Ticker: AMZN

Trades: 1/2

Daily Catalyst (Fundamental or Technical): Support Bounce or Support Break

Longer Term Catalyst: None

Bias: Long or short, based on price action

Play Type: HOD Continuation break on Major Support bounce

Trade type: Scalp

Chart:

Bigger Time frame reasoning: AMZN had sold off with SPY the previous day into support. Bouncing off support into the open.

Reason for entry: Failed to move lower and broke HOD. I missed the initial move and the second breakout. Entered long to play the third leg.

Reason for exit:

Was obviously dumping and not holding anywhere near the HOD level. It wasn’t even bouncing back and forth around the point it straight rejected and turned down. I knew this was an anticipation play so I got out as soon as it was wicked below HOD.

Review:

Bad trade over all. First of all this was the third leg up without a major consolidation period. The bulk of the move happens in the initial break and second leg up. It’s always lower probability third leg up and onwards. Execution wise i stopped out the second i saw HOD rejection which was smart. Good on the execution side bad on the entry.

Ticker: AMZN

Trades: 2/2

Daily Catalyst (Fundamental or Technical): Support Bounce or Support Break

Longer Term Catalyst: None

Bias: Long or short, based on price action

Play Type: HOD Continuation break on Major Support bounce

Trade type: Scalp

Chart:

Bigger Time frame reasoning: AMZN had sold off with SPY the previous day into support. Bouncing off support into the open.

Reason for entry: Failed to move lower and broke HOD. I missed the initial move and the second breakout. Entered long anticipating a HOD break. Saw the close above HOD. Candle didn’t break out but had a nice tail.

Reason for exit:

Wasn’t a strong close above HOD so i was more cautious on where I was expecting the stop out. The second I saw it fail to move higher I recognized the rejection.

Review:

Multiple mistakes. First is it was already up alot and the next strong leg normally happens after a major consolidation. Next it had run from the low of the minor range straight to a breakout which rarely makes a good trade. The breakout candle did not have a major volume, not a strong close. Execution with a tight stop to get it was good.