Over all very good day. As it was called Scalper’s Heaven.

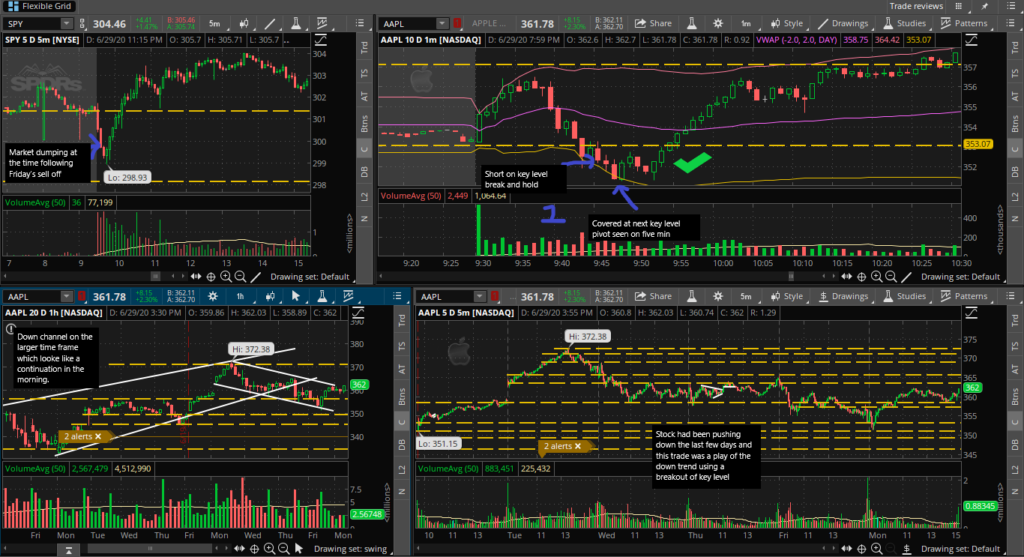

AAPL:

- This was a classic smooth LOD break play which aligned with a key level. The market was dumping and this was an almost perfect trade. The only mistake here was a slightly late entry.

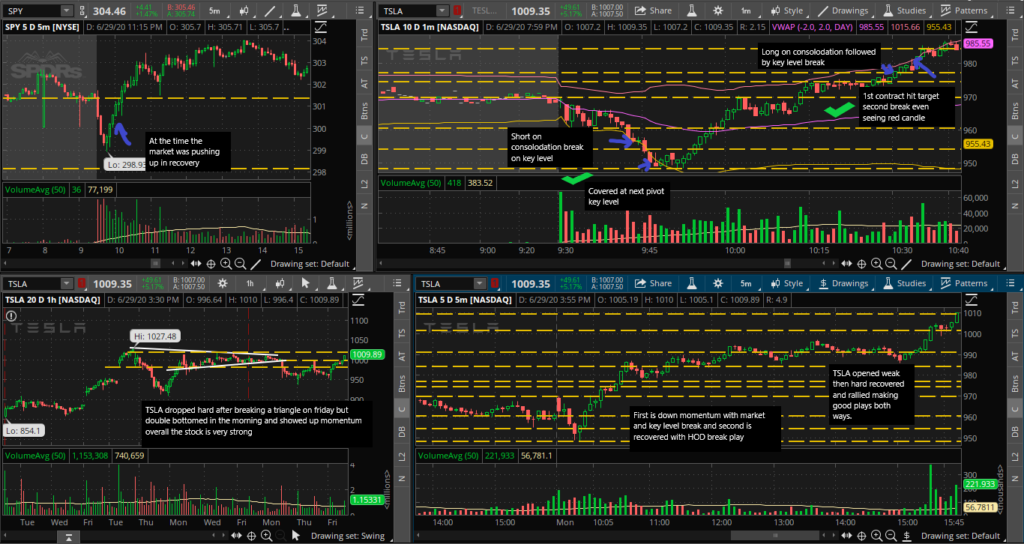

TSLA:

- The first play was a LOD and key level break anticipating a continuation down wards since market was selling off in the morning. The entry was as the stock pushed up a little to get the best price. This trade was smooth and almost perfect.

- The second trade was a play to the upside after the stock fully reversed and double bottomed and pushed up. The only problem here was that the second contract stopped out because of the red candle with tail. Considering how well the day was going holding that contract would have been a better idea.

BYND:

- BYND had a lot of bad news in general lately and has been weak. Today it had a specific catalyst. It gapped down a lot meaning instead of looking for a key level break any short setup worked so this was a perfect continuation down setup.

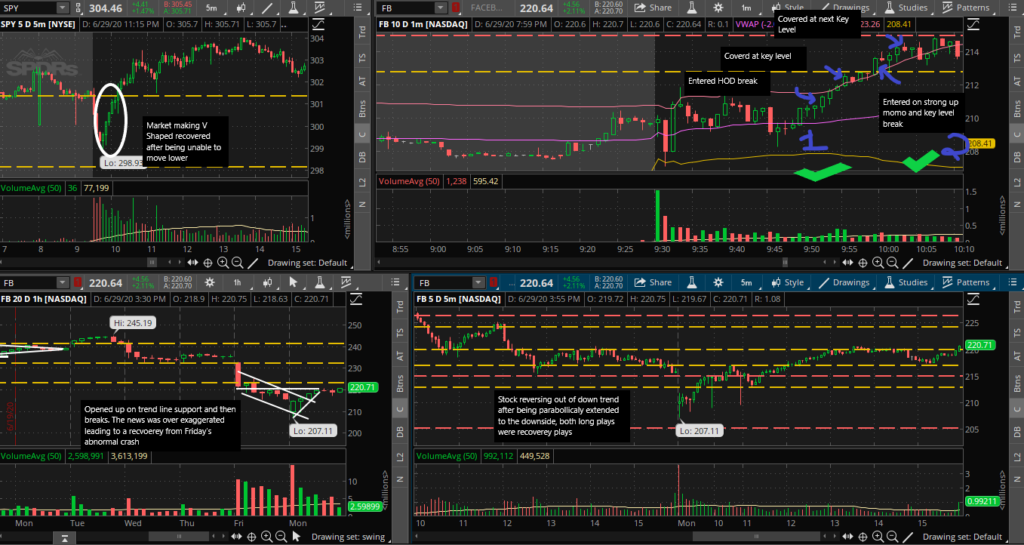

FB:

- The first FB play was a long seeing the momentum and how extended this was. There were no identified key levels here however because of how FB was so extended, the first play long HOD break was a play.

- The second play was a continuation upwards following the momentum break of key level on first play.