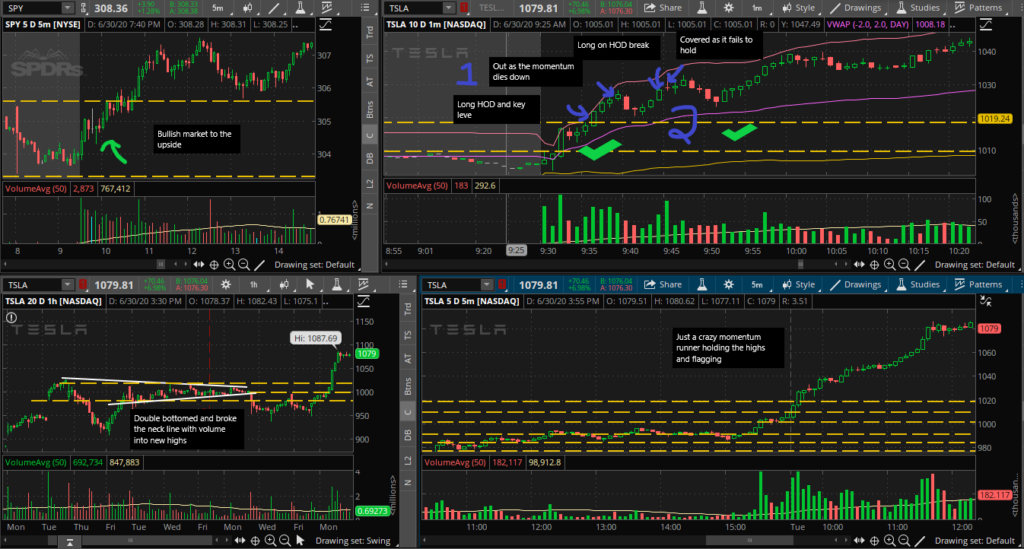

TSLA

- HOD break after seeing strong momentum to the upside in yesterday’s close. Perfect trade over all should have tried to enter earlier and have a clearer profit target.

- Continuation play. Not the best play without a consolidation HOD break isn’t the best play however if entered immediately on break can make a decent scalp. Since TSLA showed a lot of MOMO and into new all time highs this was a valid trade.

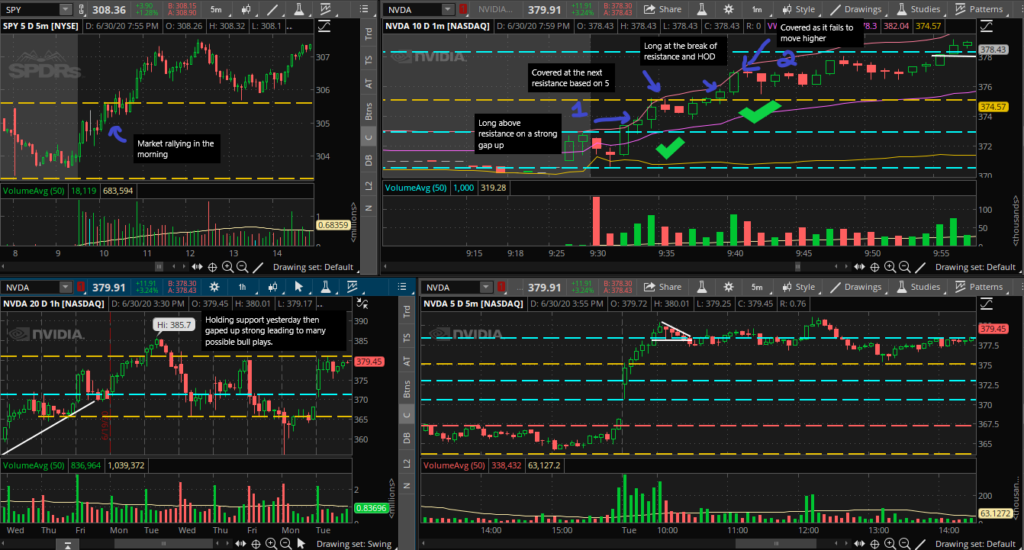

NVDA:

- Long immediately seeing the strong gap up. The whole chip sector was up. Long above resistance and the HOD.

- Continuation play of the up MOMO after another consolidation at a previous five minute resistance.

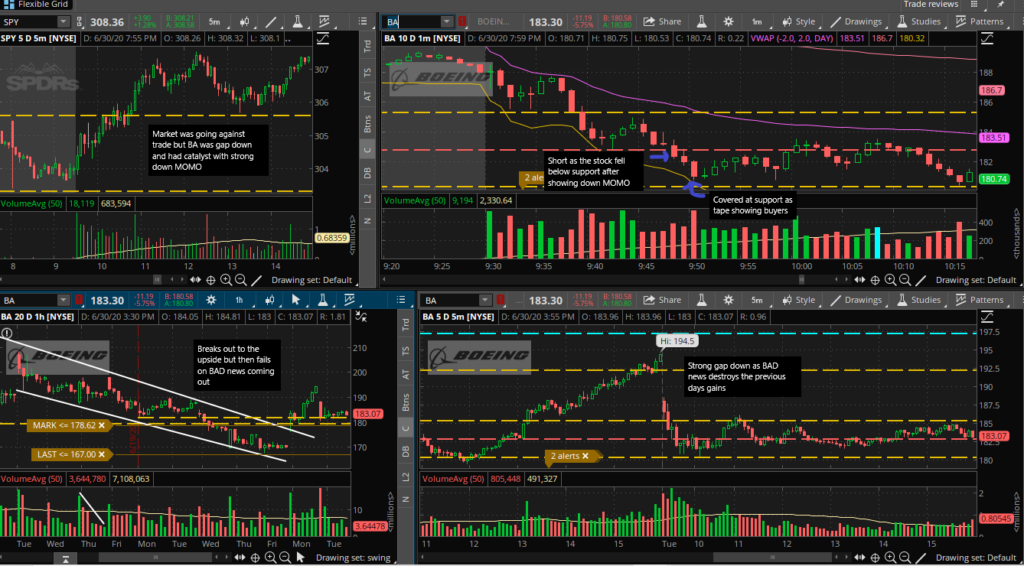

BA:

- BA gapped down hard. The short play was based on support breaking after the stock shows a strong amount of down momentum. This was an overall good trade other than the fact a better entry would be the pull back.

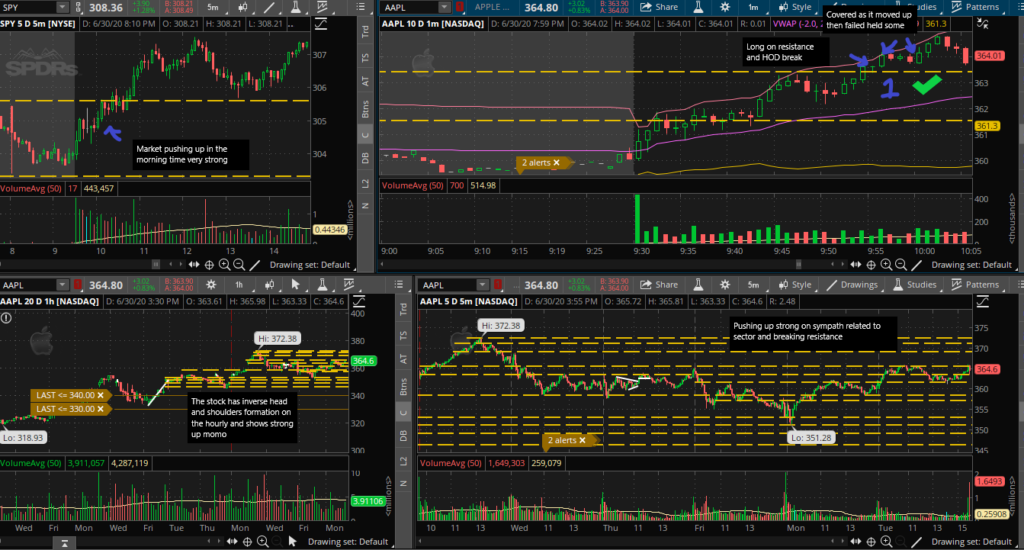

AAPL:

- AAPL Long on resistance breakout. The stock moved up strong and then consolidated. The trade was on the long breakout of that point. Over all good trade other than the stock is extended and this is more of a pull back break rather than consolidation.

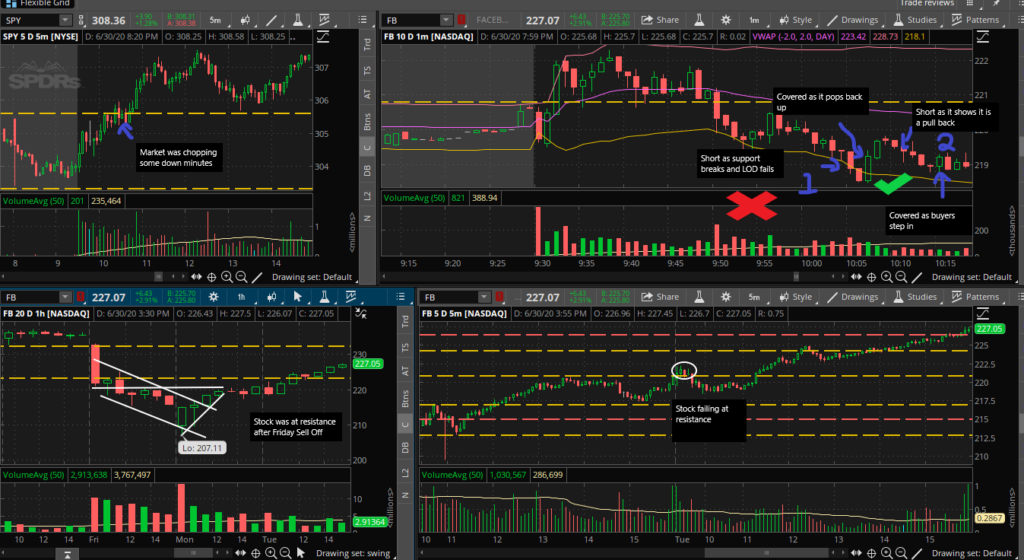

FB:

- This was a bad trade because it was a major chase. This popped up quickly and stopped out.

- Shorted as the pullback was confirmed to the downside but covered as it failed to break the low. Over all a good trade other than the fact the pullback had too much volume.