Ticker: TSLA

Trades: 1

Daily Catalyst (Fundamental or Technical): Momentum Continuation or Extensional Reversal

Longer Term Catalyst: Battery day, Anticipation of S and P 500 Addition, 5 to 1 Split, Being TSLA

Bias: Preferable Long, Short also okay

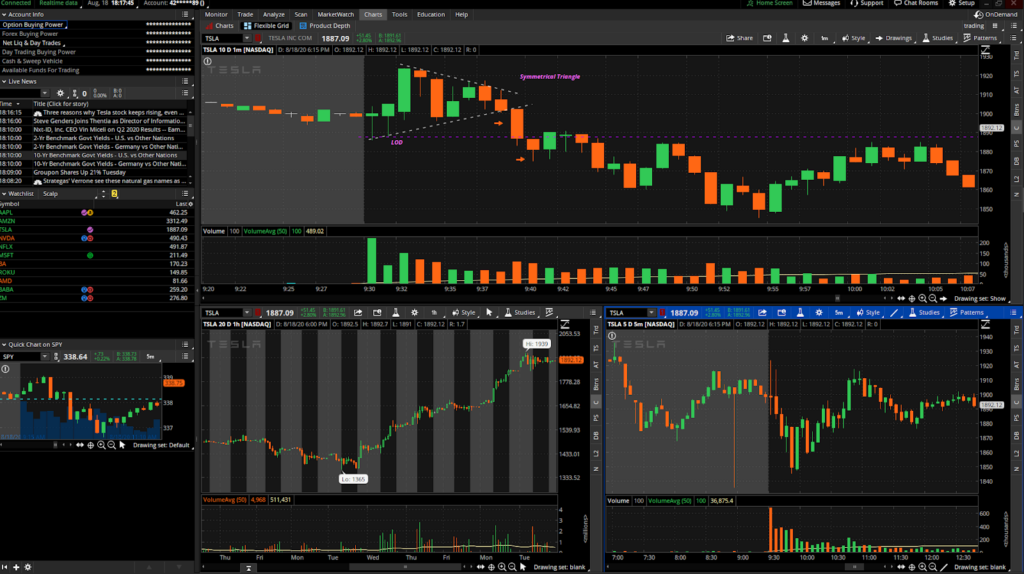

Play Type: LOD Short pattern anticipation due to extension

Chart:

Bigger Time frame reasoning: TSLA was extended over all, however could have a continuation play or a reversal. It recently broke out of a major squeeze.

Reason for entry: First it was relatively weak compared to SPY. SPY was pushing up on open however TSLA did not continue with SPY. Volume increased as it broke and the candle before the breakout candle showed high selling pressure. I entered short as that candle showed higher relative volume.

Reason for exit:

I exited as it started to pop mainly because TOS was lagging if not this could have made a decent hold for continuation for a larger gain.

Review:

I could have entered as soon as I saw the next candle pushing after seeing selling pressure in the triangle. I also should not have let hesitation slow my execution down.

Ticker: ROKU

Trades: 1

Daily Catalyst (Fundamental or Technical): PM Upgrade

Longer Term Catalyst: None

Bias: Long due to Institutional upgrade

Play Type: Opening Range Breakout on PM High due to Recoverey

Trade type: Scalp

Chart:

Bigger Time frame reasoning: Roku had recently broken support however failed to continue and was recovering from the dip.

Reason for entry: Originally it pushed down but failed to move lower showing buying pressure. SPY was rallying and ROKU was pushing with it. Volume was huge on the breakout candle. Very small wick on breakout candle.

Reason for exit:

TOS lag didn’t want to end red.

Review:

Definitely should have held longer based on the thesis instead of fear of exiting because of think or swim.

Ticker: AMZN

Trades: 1

Daily Catalyst (Fundamental or Technical): Major Squeeze release

Longer Term Catalyst: None

Bias: Long on daily and 4hr squeeze release

Play Type: Triangle on Momentum

Trade type: Day Trade

Chart:

Bigger Time frame reasoning: AMZN was ripping through its resistance form a major squeeze.

Reason for entry: level was broken and 5 min candle was pushing. Had tested the area multiple times and had not broken.

Reason for exit:

Hit my stop loss and took a loser. Fill below entry candles low.

Review:

Good thesis however bad execution. Should have waited for a candle to close with Breakout volume instead of just a slight increase in volume. I anticipated too much and entered the trade before having to drive meaning i couldn’t manage it and had to use automatic orders which got triggered before where I really would have stopped out.

W: ROKU AND TSLA

L: AMZN